Alternative Trading Board (ATB)

Background

The Chittagong Stock Exchange PLC (CSE), the first automated bourse in Bangladesh, has been reflecting remarkable footsteps in capital market since its inception in 1995. In its long expedition, CSE harbingers in making milestones in capital market with a mission to establish an effective, efficient and transparent market atmosphere of international standard for investment in Bangladesh. CSE facilitates the competent entrepreneurs to raise funds and accelerate industrial growth for overall benefit of the economy. CSE is the pioneer in launching fully automated real time online trading system on wide area network connecting multiple cities of the country. As a process of continuous development, CSE is expecting to introduce more product lines and service facilities like trading of SME platform, Islamic investment window, Exchange Traded Fund (ETF), Commodity Derivatives Market etc. to its existing basket for robust development of the capital market. CSE trading platform supports multi asset class and multi-channel trading facilities by which investors can trade from any place locally or globally in different instruments of multiple segments of capital market.

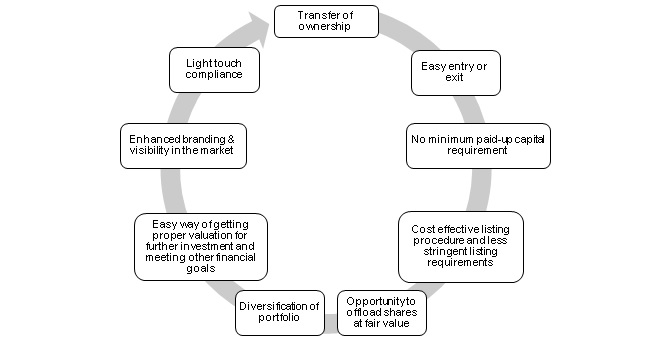

As part of its relentless quest for development, CSE is launching Alternative Trading Board or ATB as a separate market for trading unlisted or de-listed securities or units which are not listed with the main board. CSE will facilitate a formal channel for transfer of ownership that will reflect in a flexible and liquid market for unlisted securities and investment. As a custodian of capital flow, CSE will develop a global and instantaneous network for trading besides the main board. ATB listed entities will gain the similar image, branding and acceptance as a listed entity with balanced maintenance of regulatory requirements. By being listed with ATB, an entity will be part of vast support network of professionals of capital market. It will also act as a long-term motivator for the employees of ATB listed entity. With small legal fees compared to the conventional process and no minimum paid up capital restrictions, CSE will provide secured network for purchase and sale of unlisted securities. Listing with ATB board will allow revealing the fair valuation of an entity which will take a step ahead in drafting future financial strategy of ATB listed entity. CSE ATB platform will provide liquidity, visibility, credibility and marketability with an access to a global diverse pool of capital and investors. Through the inauguration of ATB board, CSE expects to contribute towards tangible and meaningful progress in real economy of Bangladesh.

What is ATB

Alternative Trading Board or ATB is a separate trading platform for trading of unlisted, de-listed equity and debt securities, units of open-end mutual fund and alternative investment funds registered under the securities and exchange commission.

ATB provides a secured and formal channel for transfer of ownership only for investment or disinvestment purpose not for day trading or raising capital.

Why Choose ATB

The firms or companies that are not ready to raise capital from the public, that want to transfer the ownership or get de-listed from the exchange, their sponsors, directors, or private equity investors would find a way of easy exit to enjoy a liquid market through the ATB platform. On the contrary, this platform will offer the way of easy entry to investors with similar sophisticated profile.

The Chittagong Stock Exchange PLC is offering the ATB platform which is a secondary market place of buying or selling shares of unlisted or delisted companies, bonds, and collective investment fund units privately.

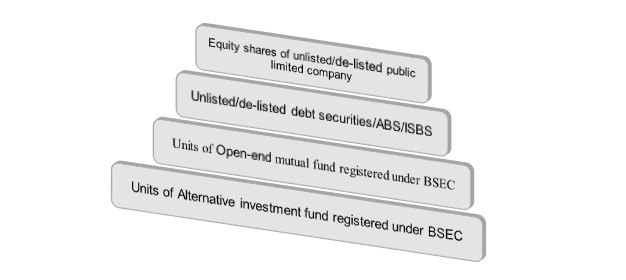

Which Securities can be listed in ATB

*De-listed securities= security listed and subsequently de-listed with the exchange for any reason whatsoever

*ABS=Asset Backed Securities, ISBS= Islamic Shari'ah based securities

Benefits of Listing

Listing Procedure

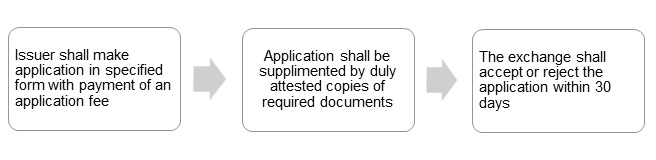

Equity securities

- The issuer of any un-listed or de-listed equity securities shall make application in specified form as per Annexure 1 of Schedule-A of Chittagong Stock Exchange (Alternative Trading Board) Regulations, 2022 to the Exchange for listing and availing trading facilities at ATB with payment of an application fee of TK. 10000.

- The application shall be submitted with following documents duly attested by Managing Director or Chief Executive Officer or authorized person of the applicant:

- Copy of Memorandum & Articles of Association, certificate of incorporation, certificate of commencement of business of the company certified by the Registrar of Joint Stock Companies and Firms;

- Return of allotment of shares of the company duly certified by the Registrar of Joint Stock Companies & Firms confirming issuance of shares prior to listing;

- Particulars of directors certified by the Registrar of Joint Stock Companies and Firms;

- Name, address (both residence & business) and NID of directors and their directorship of other companies listed with the Exchange, if any;

- Audited financial statements for last 3 (three) years or such shorter period during which the issuer was in commercial operation;

- Description of property, plant and equipment & Liabilities, etc.

- The Exchange shall examine the application and make its decision regarding listing or rejection within 30 (thirty) days of receipt of such application. Otherwise, it shall issue a rejection letter, stating the reason(s) for such rejection, within 30 (thirty) days of receipt of the application.

The application process can be simply illustrated as:

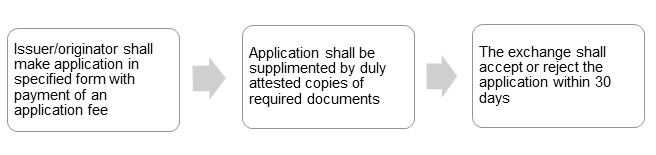

Debt securities

- The issuer or originator of any unlisted or delisted debt securities or ABS or ISBS shall make application in specified form as per Annexure 1 of Schedule-A of Chittagong Stock Exchange (Alternative Trading Board) Regulations, 2022 to the Exchange for listing and availing trading facilities at ATB with payment of an application fee of TK. 10000.

- The application shall be submitted with following documents duly attested by Managing Director or Chief Executive Officer or authorized person of the applicant:

- Copy of consent letter, Information Memorandum (IM) or offer document and Trust Deed as approved by the Commission under the respective Rules;

- Copy of Memorandum, Articles of Association, Copy of the certificate of incorporation, the certificate of commencement of business of the issuer or originator or such other documents, if applicable;

- Copies of relevant approval of concerned Ministry/Government Authority/Statutory Body/Bangladesh Bank/Local Authority, if required;

- Copy of resolution of Directors or Board of Governors or trustee of the issuer or originator authorizing the listing application;

- Name of trustee and names & particulars of the members of Board of Trustee;

- Audited financial statements for the last 3 (three) years or such shorter period during which the issuer was in operation;

- Undertakings of the issuer or originator and its directors for obtaining CIB Report from Bangladesh Bank; etc.

- The Exchange shall examine the application and make its decision regarding listing or rejection within 30 (thirty) days of receipt of such application. Otherwise, it shall issue a rejection letter, stating the reason(s) for such rejection, within 30 (thirty) days of receipt of the application.

The application process can be simply illustrated as:

Open-end Mutual Fund

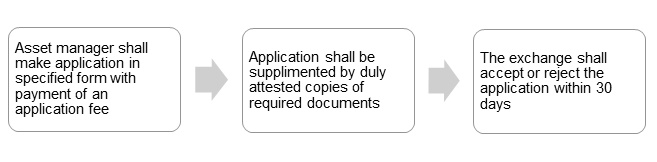

- The asset manager of any open-end mutual fund shall make application in specified form as per Annexure 1 of Schedule-A of Chittagong Stock Exchange (Alternative Trading Board) Regulations, 2022 to the Exchange for listing and availing trading facilities at ATB with payment of an application fee of TK. 10000.

- The application shall be submitted with following documents duly attested by Managing Director or Chief Executive Officer or authorized person of the applicant:

- Copy of consent letter, prospectus and registered Trust Deed as approved by the Commission under the Securities and Exchange Commission (Mutual Fund) Rules, 2001;

- An undertaking given by the asset manager to provide net asset value (NAV) per unit at cost and market price to the Exchange and disclose the same at the official website of the asset manager on daily basis as well as disclose the detailed portfolio or holdings of assets of the fund in official website of the asset manager.

- Certified true copy of the certificate of incorporation, certificate of commencement (if applicable), registration certificate to carry on business or services of business of asset management company;

- A copy of resolution passed by the Trustee Board approving the listing of units of the fund on the Exchange;

- Names of Directors of the asset manager along with directorship of other companies listed on the Exchange (on asset manager’s letterhead);

- Audited financial statements of the fund for the last 3 (three) years or such shorter period during which fund was in operation;

- Certified copies of agreements with all managing agents (i.e., trustee, asset manager, custodian, selling/dealing agents and panel broker), etc.

- The Exchange shall examine the application and make its decision regarding listing or rejection within 30 (thirty) days of receipt of such application. Otherwise, it shall issue a rejection letter, stating the reason(s) for such rejection, within 30 (thirty) days of receipt of the application.

The application process can be simply illustrated as:

Alternative Investment Fund

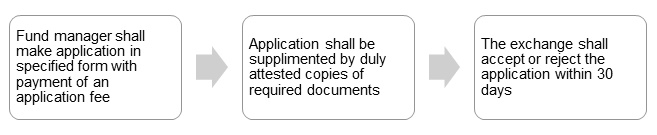

- The fund manager of any alternative investment fund shall make application in specified form as per Annexure 1 of Schedule-A of Chittagong Stock Exchange (Alternative Trading Board) Regulations, 2022 to the Exchange for listing and availing trading facilities at ATB with payment of an application fee of TK. 100 00.

- The application shall be submitted with following documents duly attested by Managing Director or Chief Executive Officer or authorized person of the applicant:

- Copy of consent letter, placement memorandum, registration certificate of alternative investment fund, due diligence certificate of the fund manager & trustee and registered Trust Deed as approved by the Commission under the Bangladesh Securities and Exchange Commission (Alternative Investment) Rules, 2015;

- An undertaking given by the fund manager to provide net asset value (NAV) per unit at cost and fair or market price to the Exchange and disclose the same at the official website of the asset manager on quarterly basis as well as disclose the detailed portfolio or holdings of assets of the fund in official website of the fund manager as per the provisions of the Bangladesh Securities and Exchange Commission (Alternative Investment) Rules, 2015, with an intimation to the Exchange;

- Certified true copy of the certificate of incorporation, certificate of commencement (if applicable), registration certificate to carry on business or services of business of fund management company under the Bangladesh Securities and Exchange Commission (Alternative Investment) Rules, 2015;

- A copy of resolution passed by the Trustee Board approving the listing of units of the fund on the Exchange;

- Names of Directors of the fund manager along with directorship of other companies listed on the Exchange (on fund manager’s letterhead);

- Audited financial statements of the fund for the last 3 (three) years or such shorter period during which fund was in operation;

- Certified copies of agreements with all managing agents (i.e., trustee, fund manager or any other party); etc.

- The Exchange shall examine the application and make its decision regarding listing or rejection within 30 (thirty) days of receipt of such application. Otherwise, it shall issue a rejection letter, stating the reason(s) for such rejection, within 30 (thirty) days of receipt of the application.

The application process can be simply illustrated as:

Listing Fees

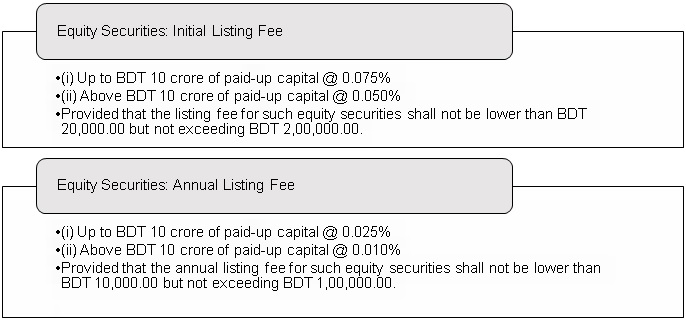

Equity

Issuer of equity securities shall pay to the Exchange initial listing fee at the following rates specified in the following table.

- Provided that initial listing fee shall not be imposed for existing equity securities (transferred as directed by the Bangladesh Securities and Exchange Commission) before these regulations come into force.

- Whenever issuer of equity securities increases the number of securities listed at ATB, shall pay the Exchange a fee at the same rate as provided in following table for the additional securities to be listed.

Every Issuer of equity security shall pay annual listing fee to the Exchange within 31st March of every Gregorian calendar year at the rates specified in above table.

- Provided that in case of failure to pay the annual listing fee within the stipulated time, the Exchange will notify and finally delist within 6 (six) months from the deadline of payment.

- Proportionate annual listing fee shall be applicable for additional securities for the number of days the new securities remain outstanding during the year of issuance;

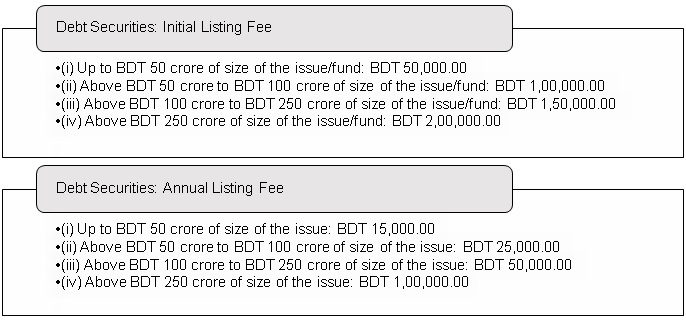

Debt

The issuer or originator of debt securities or ABS or ISBS shall pay to the Exchange an initial listing fee at the rates specified in following table.

-Provided that initial listing fee shall not be imposed for existing debt securities, ABS, ISBS (transferred as directed by the Bangladesh Securities and Exchange Commission) before these regulations come into force.

-Whenever issuer or originator of debt securities or ABS or ISBS increases the number of securities listed at ATB, shall pay the Exchange a fee at the same rate as provided in below table for the additional securities to be listed.

Every issuer or originator of debt securities or ABS or ISBS shall pay annual listing fee to the Exchange within 31st March of every Gregorian calendar year at the rates specified in above table.

-Provided that in case of failure to pay the annual listing fee within the stipulated time, the Exchange will notify and finally delist within 6 (six) months from the deadline of payment.

-Proportionate annual listing fee shall be applicable for additional securities for the number of days the new securities or units remain outstanding during the year of issuance.

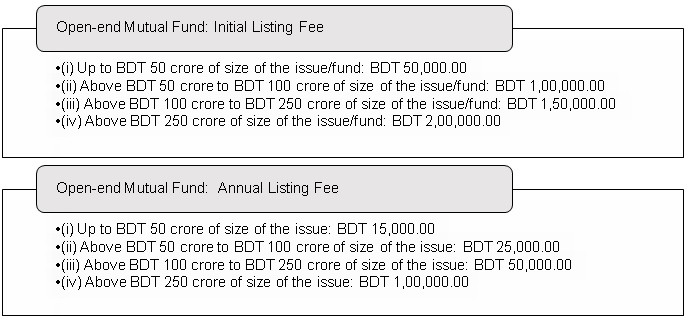

Open-end Mutual Fund

The asset manager of open-end mutual fund shall pay to the Exchange an initial listing fee at the rates specified in following table.

-Provided that initial listing fee shall not be imposed for existing funds (transferred as directed by the Bangladesh Securities and Exchange Commission) before these regulations come into force.

-Whenever asset manager or fund manager of any fund increases the number units listed at ATB, shall pay the Exchange a fee at the same rate as provided in below table for the additional units to be listed;

Every issuer or originator or asset manager or fund manager of any fund shall pay annual listing fee to the Exchange within 31st March of every Gregorian calendar year at the rates specified in above table.

-Provided that in case of failure to pay the annual listing fee within the stipulated time, the Exchange will notify and finally delist within 6 (six) months from the deadline of payment.

-Proportionate annual listing fee shall be applicable for additional units for the number of days the new securities or units remain outstanding during the year of issuance.

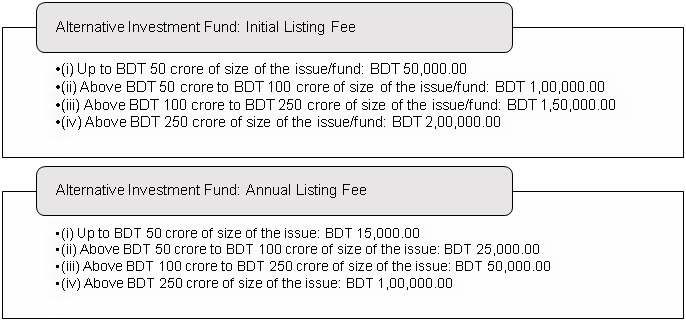

Alternative Investment Fund

The fund manager of any alternative investment fund shall pay to the Exchange an initial listing fee at the rates specified in following table.

-Provided that initial listing fee shall not be imposed for existing funds (transferred as directed by the Bangladesh Securities and Exchange Commission) before these regulations come into force.

-Whenever fund manager of any fund increases the number units listed at ATB, shall pay the Exchange a fee at the same rate as provided in below table for the additional units to be listed;

Every issuer or originator or asset manager or fund manager of any fund shall pay annual listing fee to the Exchange within 31st March of every Gregorian calendar year at the rates specified in above table.

-Provided that in case of failure to pay the annual listing fee within the stipulated time, the Exchange will notify and finally delist within 6 (six) months from the deadline of payment.

-Proportionate annual listing fee shall be applicable for additional units for the number of days the new securities or units remain outstanding during the year of issuance.

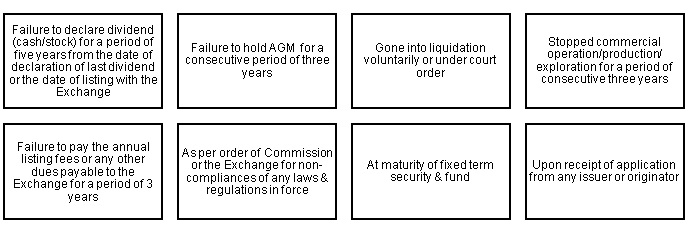

De-listing

Any ATB listed securities or units of any fund listed with ATB may be de-listed for any of the following reasons:

Provided that no securities shall be de-listed unless such the issuer or originator of any ATB listed securities or asset manager or fund manager of any fund listed with ATB has been given an opportunity of being heard.

Trading procedure

1. Equity Securities

- The trading or transaction system of ATB shall not be for day trading of any securities or units of any fund. This trading or transaction system shall be for alternative transfer system of ownership of any securities or units of any fund and only for the investment or disinvestment purpose.

- Every trading or transaction shall be executed at ATB through stock broker of the Exchange.

- Trading or transaction shall be executed on the best bid and best ask order of the buyer and seller, i.e., at the order driven or auction market platform.

- The issuer shall inform the Exchange about the list of designated stock broker at least 3 (three) working days prior to commencement of offer for sale.

- Stock broker(s) designated by the issuer company shall commence the offer for sale of equity securities at ATB in favor of the primary shareholders for the first two trading days.

- For the first two trading days, circuit breaker shall be 4% (four percent) on the fair value calculated as per Annexure 2 under Schedule A of Chittagong Stock Exchange (Alternative Trading Board) Regulations, 2022.

- Trading shall remain closed in the third day to allow the market to distribute the shares in the first two trading days.

- From the fourth trading day regular circuit breaker shall be 5% (five percent) on the fair value.

- If any investor or beneficial owner makes any gain by the purchase and sale, or the sale and purchase, of any equity security within a period of less than 3 (three) months, such investors or beneficial owner shall make a report to the Exchange and tender the amount of such gain to the investors’ protection fund.

- The primary shareholders including the sponsors and directors of the company (except transferred to ATB) securities shall offer for sale at least 10% (ten percent) of the shareholdings in the company within 30 (thirty) trading days from the date of commencement of trading however, they shall not offload or sell more than 49% (forty-nine percent) equity securities or ordinary shares of the company.

- Among the primary shareholders, the sponsor(s) and/or directors shall at all time jointly hold at least 51% (fifty-one percent) ordinary shares of the company.

- The sponsors or directors of the issuer company shall be restricted from buying ordinary shares for 1 (one) year from the date of listing of its securities at ATB.

2. Debt Securities

- The trading or transaction system of ATB shall not be for day trading of any securities or units of any fund. This trading or transaction system shall be for alternative transfer system of ownership of any securities or units of any fund and only for the investment or disinvestment purpose.

- Every trading or transaction shall be executed at ATB through stock broker of the Exchange.

- If coupon or principal payment of any debt securities or ABS or ISBS is guaranteed by any bank or insurance company or any credit enhancement, trading or transaction of such debt securities shall be traded or executed in the order driven market at ATB using yield-based trading platform where the buy or sale order of the trade shall be at clean price. Provided that in case of ISBS, trading or settlement price shall be determined in line with the opinion of Shari’ah Advisory Council.

Clean Price: Clean price means the present value of the debt securities or ABS or ISBS discounted at the required or desired yield of the buyer or seller.

- Trading or settlement of all other debt securities or ABS or ISBS, which has no bank guarantee or insurance guarantee for coupon or principal payment shall be executed on the best bid and best ask order of the buyer and seller, i.e., in the order driven or auction market platform.

- The issuer/originator shall inform the Exchange about the list of designated stock broker at least 3 (three) working days prior to commencement of offer for sale.

- Stock broker(s) designated by the issuer company/originator shall commence the offer for sale of debt securities at ATB in favor of initial seller or any broker designated by the initial seller for the first two trading days.

Initial seller is a seller of any debt securities or ABS or ISBS who holds such debt securities or ABS or ISBS at the time of listing or before listing of such securities.

- For the first two trading days, circuit breaker shall be 4% (four percent) on the present value calculated at least 10% (ten percent) discount rate per annum.

- Trading shall remain closed in the third day to allow the market to distribute the shares in the first two trading days.

- From the fourth trading day regular circuit breaker shall be 5% (five percent) on the fair value.

3. Open-end Mutual Fund

- The trading or transaction system of ATB shall not be for day trading of any securities or units of any fund. This trading or transaction system shall be for alternative transfer system of ownership of any securities or units of any fund and only for the investment or disinvestment purpose.

- The Exchange shall provide a web-based platform for selling and redemption or repurchasing of units of open-end mutual fund at ATB as an over- the- counter (OTC) of an asset manager;

- The sale and redemption (repurchase) of units of open-end mutual fund shall be executed at the price (i.e., sale and redemption or repurchase price) as declared or quoted by the respective asset manager in accordance with the provisions of the Securities and Exchange Commission (Mutual Fund) Rules, 2001.

- Every trading or transaction shall be executed at ATB through stock broker of the Exchange. Every stock broker of the Exchange shall act as a selling or dealing agent of the asset manager for trading units of the open-end mutual fund.

- Every asset manager shall publish net asset value per unit of each open-end mutual fund scheme at cost and market value at least 30 (thirty) minutes before the start of trading at ATB, which shall also be displayed at the trading monitor.

- The sale and redemption (repurchase) price per unit of each open-end mutual fund scheme shall be quoted by the asset manager in the order collection platform of the Exchange at least 30 (thirty) minutes before the start of every trading day at ATB.

- Maximum redemption or repurchase size (number of units) for each trading day shall be set by the asset manager at least 30 (thirty) minutes before the start of trading, which shall also be displayed at the trading monitor;

- Minimum and maximum market lot for sale and redemption or repurchase shall be set by the asset manager from time to time, which shall also be displayed at the trading monitor.

4. Alternative Investment Fund

- The trading or transaction system of ATB shall not be for day trading of any securities or units of any fund. This trading or transaction system shall be for alternative transfer system of ownership of any securities or units of any fund and only for the investment or disinvestment purpose.

- Every trading or transaction shall be executed at ATB through stock broker of the Exchange.

- Trading or transaction shall be executed on the best bid and best ask order of the buyer and seller, i.e., at the order driven or auction market platform.

- The fund manager shall inform the Exchange about the list of designated stock broker at least 3 (three) working days prior to commencement of offer for sale of units of alternative investment fund.

- Stock broker(s) designated by the fund manager shall commence the offer for sale of units of alternative investment fund at ATB in favor of initial seller or any broker designated by the initial seller for the first two trading days.

Initial seller is a seller of units of any alternative investment fund who holds such units at the time of listing or before listing of such units of the fund.

- For the first two trading days, downward circuit breaker shall be 4% (four percent) on the net asset value per unit calculated on the basis of latest audited financial statements, but no transaction shall be executed exceeding net asset value per unit.

- From the fourth trading day regular circuit breaker shall be 5% (five percent) but no transaction shall be executed exceeding net asset value per unit.

Settlement procedure

- The clearing and settlement of securities including units of any fund listed with ATB shall be in accordance with the regulations of the Chittagong Stock Exchange (Settlement of Transactions) Regulations, 2013 or any subsequent amendments thereto, unless otherwise anything contained in regulation No.9 of these regulations.

- All trading and settlement shall be executed in the manner as per the regulations for main board if not otherwise stated in ATB regulations.

- If coupon or principal payment of any debt securities or ABS or ISBS is guaranteed by any bank or insurance company or any credit enhancement, the settlement of trade shall be at dirty price. Provided that in case of ISBS, trading or settlement price shall be determined in line with the opinion of Shari’ah Advisory Council.

Clean Price: Clean price means the present value of the debt securities or ABS or ISBS discounted at the required or desired yield of the buyer or seller.

Dirty Price: Dirty price means sum of Clean Price and the interest or profit accrued on holding period of the debt securities or ABS or ISBS.

Margin trading

- No margin loan facilities shall be applicable for investors in trading of securities or units at ATB.

- Margin for trading of ATB listed securities or units of any fund listed with ATB shall be applicable for a stock broker in accordance with the Chittagong Stock Exchange (TREC Holder’s Margin) Regulations, 2013.

Pre-Listing Compliance

Unlisted/Delisted Equity Securities

|

Nature of Ownership |

Issuer of unlisted/delisted equity securities shall be registered as public limited company under the Companies Act, 1994 (Act No. XVIII of 1994). |

|

Format of securities |

Issuance shall be in dematerialized form |

|

Annual General Meeting |

Regular |

|

Financial Statement Preparation |

Following International financial reporting standards (IFRS) |

|

Financial Statement Audit |

Following international standards on auditing (ISA) |

|

Undertakings |

A declaration to abide by these regulations shall be provided. |

Debt Securities

|

Approval |

The issuance of debt securities or ABS or ISBS shall be approved by the Commission. |

|

Format of securities |

Issuance shall be in dematerialized form |

|

Annual General Meeting |

Regular |

|

Financial Statement Preparation |

Following International financial reporting standards (IFRS) |

|

Financial Statement Audit |

Following international standards on auditing (ISA) |

|

Undertakings |

A declaration to abide by these regulations shall be provided. |

Open-End Mutual Fund

|

Registration |

The open-end mutual fund shall be registered under the Securities & Exchange Commission (Mutual Fund) Rules, 2001. |

|

Format of unit |

Issuance of unit of open-end mutual fund shall be in dematerialized form |

|

Financial Statement Preparation |

Following International financial reporting standards (IFRS) |

|

Financial Statement Audit |

Following international standards on auditing (ISA) |

|

Undertakings |

A declaration to abide by these regulations shall be provided. |

Alternative Investment Fund

|

Registration |

The Alternative Investment Fund shall be registered under the Bangladesh Securities and Exchange Commission (Alternative Investment) Rules, 2015 |

|

Dematerialized |

Issuance of units of Alternative Investment fund shall be in dematerialized form |

|

Financial Statement Preparation |

Following International financial reporting standards (IFRS) |

|

Financial Statement Audit |

Following international standards on auditing (ISA) |

|

Undertakings |

A declaration to abide by these regulations shall be provided. |

Post-Listing Compliance

|

Financial Statement Preparation |

Following the international financial reporting standards (IFRS) |

|

Financial Statement Audit

|

Following international standards on auditing (ISA) |

|

Audit Shall be done within 120 (one hundred and twenty) days from the date on which the issuer ’s or fund’s financial year ends and a copy of such audited financial statements shall be submitted to the Commission and the Stock Exchange within 14 (fourteen) days. |

|

|

Statement Availability |

Detailed financial statements and Annual Reports shall be made available in their own website as well as in the website of the Exchange. |

|

Submission of Annual Report |

Hard or Soft copy of annual report shall be submitted to the shareholders or unit holders at least 21(twenty-one) days before the general meeting. |

|

Fixation of Record Date |

Required notice period shall be at least 7 (seven) trading days but not exceeding 30 (thirty) trading days from the date of the concerned Board of Directors’ or trustee board’s meeting. |

|

Holding Annual General Meeting |

Within 45 (forty-five) working days from the record date. |

|

Notice of General Meeting to Exchange |

At least 21 (twenty-one) days prior to AGM and to EGM. |

|

Attendance, Minutes and Filings |

Issuer company shall furnish copies of attendance of shareholders and minutes of its general meeting (AGM/EGM) to the Exchange and to the Commission within 10 (ten) working days of holding of such general meeting |

|

Dividend Compliance Report submission |

A compliance report shall be submitted to the Exchange within 7 (seven) working days of last date of dividend disbursement. |

|

Disclosure of Price Sensitive Information |

Written report of its price sensitive information shall be made within 30 (thirty) minutes of the decision on such information to the Exchange through electronic communication and by special messenger or by courier service. |

|

Statement of Yearly Security Holding Position and Yearly Free Float Reporting |

Submission shall be on yearly basis within 30 (thirty) days of end of English Calendar year to the Exchange. |

|

e-Filing of Information/Documents |

Submission of Information/Documents shall be filed in the specified electronic format to the Exchange as and when required by the Exchange |

Legal Framework

- Rule Bangladesh Securities and Exchange Commission (ATB) Rules, 2019

- Regulation Chittagong Stock Exchange (ATB) Regulations, 2022

- Directives & Notifications

- Forms

Stock Broker

Trading

CSE Training

Useful Links

- Bangladesh Securities and Exchange Commission

- BSEC Facebook page

- Electronic Subscription System

- Central Depository Bangladesh Limited

- Central Counterparty Bangladesh Ltd(CCBL)

- Capital Market Stabilization Fund (CMSF)

- Financial Literacy Program

- Bangladesh Bank

- Export Promotion Bureau

- National Board of Revenue

- Registrar of Joint Stock Companies and Firms

©2024 Chittagong Stock Exchange PLC. All rights reserved.

20:43:57 (BST)

20:43:57 (BST)