Introduction

The Chittagong Stock Exchange (CSE), the first automated bourse of the country began its journey in 10th October of 1995 with a mission to create an effective, efficient and transparent market atmosphere of international standard to save and investment in Bangladesh in order to facilitate the competent entrepreneurs to raise funds and accelerate industrial growth for overall benefit of the economy. CSE is the pioneer in launching fully automated real time online trading system on wide area network connecting multiple cities of the country. In its long journey, CSE has taken various remarkable initiatives for utmost development of Bangladesh capital market. CSE is working to introduce new products and services like trading of small capital companies platform, Shariah market, Exchange Traded Fund (ETF), Commodity Exchange, Derivatives Market etc. for the development of the capital market. CSE provides robust trading platform supporting multi asset class and multi-channel trading facilities by which investors can trade from any place in locally or globally through mobiles, Tablet etc.

As part of its continuous development process, CSE has launched its Small Capital Companies platform named CSE SME by which the entrepreneurs of small capital companies can raise their funds through Qualified Investor offer. It provides SMEs equity financing opportunities to grow their business from expansion to acquisition and also to prepare themselves for further growing up exploring potentials.

Background, Importance and Economic Impact of SMEs

Cottage, Micro, Small and Medium industries are treated as the engines of growth and drivers of innovation worldwide. They play a significant role in driving economic growth and generating jobs. Small and Medium Enterprises (SMEs) and the agricultural products play an important role in achieving the recognition of Bangladesh as a developing country, as such, the development of the SME industry is considered more seriously.

In Bangladesh, the sector is changing the face of the economy. SMEs are playing a vital role for the country's accelerated industrialization and economic growth, employment generation and reducing poverty. The total number of SMEs in Bangladesh is estimated to be 79,754 establishments or more. Of them, 93.6 percent are small and 6.4 percent are medium. They account for about 45 percent of manufacturing value addition, about 80 percent of industrial employment, about 90 percent of total industrial units and about 25 percent of the labour force. Their total contribution to export earnings varies from 75 percent to 80 percent.

Bangladesh is the 39th largest country in the world in nominal terms and 29th largest country in terms of PPP and 3rd fastest growing country all over the world. However, the present contribution of SMEs to GDP growth of Bangladesh is only 25 percent, whereas in India, Singapore and Malaysia it is 40 – 50 percent. There is a huge scope for SMEs to contribute more profusely to GDP growth of Bangladesh. The development of small and medium enterprises will not only increase the number of entrepreneurs, but also create jobs for the unemployed people. It will also help build a poverty-free Bangladesh in line with Sustainable Development Goals (SDGs).

SMEs can reduce the urban migration in the capital and other major cities, increase cash flow in rural areas, and thereby enhance the standard of living of the rural people. SMEs are widely distributed all over the country which means developing SMEs will play a major role in bridging the urban-rural income gap and contribute towards inclusive growth. In a way, inclusive growth can only be achieved through a vibrant SME sector in a country like Bangladesh.

Regional markets led by global value chains (GVCs) and free trade agreements (FTAs) has increasingly put the spotlight on SMEs. Now more than ever, SMEs in Asia have the opportunity to engage in international trade given the falling barriers to trade and fragmentation of production whereby the manufacturing of final goods is spread over firms located in several countries, each one undertaking an individual task of the overall process. Firms no longer need to have the expertise to export to a modern market; instead, they can simply support the value chain as suppliers of intermediate inputs in the form of parts and components, and act as subcontractors several levels below the ultimate buyer. Increased internationalization through trade and participation in GVCs provides SMEs in Asia the opportunity to achieve economies of scale, expand market share, and increase productivity.

SMEs in Bangladesh should see whether they could be part of this new phenomenon. It is worth noting that SMEs that invest in technology and those with high labor productivity are more likely to be part of the GVC. Bangladesh needs to maximize the benefits derived from the SME sector, as this sector plays a pivotal role in promoting and sustaining the industrial as well as overall economic growth.

The target of achieving double-digit growth hinges largely on the performance of the small and medium enterprises. It is important to understand the operational strengths and weaknesses of the SME sector for pragmatic policy making and effective implementation of these policies. The government has rightly identified SMEs as the priority sector for transforming Bangladesh into a middle-income country. In line with the government's initiatives, Bangladesh Bank (central bank) and the Bangladesh Securities and Exchange Commission (BSEC) are being instrumental in designing and implementing SME sector development initiatives as part of the development financing agenda.

Highlights - CSE Small Capital Platform (CSE SME)

“Small Capital Company” means a public company limited by shares, of which paid-up capital shall stand from Tk. 50 (fifty) million to below Tk. 300 (three hundred) million, after raising capital through the Qualified Investor Offer (QIO); Small-cap stocks are shares of ownership of small businesses. It gives them easy access to funds to invest in their growth. A small capital company is usually well past the initial start-up phase. That's because it has to be doing well enough to qualify for Qualified Investor Offering. That takes a small business from the private equity phase to being a publicly owned company.

Small capital platform means separate platform in an Exchange for trading of securities issued by small capital companies.

CSE Small Capital Platform (CSE SME) is a credible, transparent and efficient market place to bring about convergence of qualified investors and small capital companies of the country having low paid up capital. It is platform for the best of emerging corporate to raise capital from Qualified Investors and High Net worth Individuals (HNIs). CSE SME offers to Small Capital Companies (SCC) to grab the opportunity:

• to offer its securities to the qualified investors;

• to be listed with the stock exchange;

CSE has established a separate trading platform with utmost sophisticated features side by side its main trading platform to cater smooth trading function to its investors. CSE has a dedicated team to support the potential Small Capital Companies to bring into the market and also the qualified investors offering the most dedicated services in this respect.

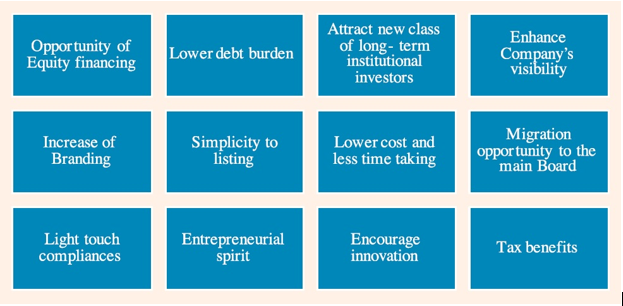

Benefits of Listing on CSE SME

CSE SME shall get the following benefits:

Trading & Settlement Procedures

TRADING:

Only Qualified Investors as defined in rule 2(1)(f) of the Bangladesh Securities and Exchange Commission (Qualified Investor Offer by Small Capital Companies) Rules, 2018 are eligible to participate in the trading of securities in Small Capital Platform (CSE SME). Individual investors shall be considered as Qualified Investor (QI), who have already registered/will be registered with Electronic Subscription System (ESS) of the Exchanges having a minimum investment of Tk 1,00,00,000/- (Tk. One Core Only) in the listed securities at market price.

• After listing, Trading in SME platform will be similar to the Main Market of CSE. Qualified Investors will have to register with a Broker and buy or sell shares through their accounts.Provided that, in case of transaction in the Bulk Market the minimum order size of securities shall be Tk. 0.2 million.

SETTLEMENT:

Clearing and settlement procedure of securities transacted in the Small Capital Companies platform of CSE will follow the regular settlement cycle (i.e. A,B,G & N category) as per Chittagong Stock Exchange (Settlement of Transactions) Regulations, 2013.

Settlement Day for Securities and Funds:

- Settlement day (Securities) = T+0

- Settlement Day (Funds) =T+1

Clearing Day for Securities and Funds:

- Clearing Day (Securities and Funds) = T+2

Criteria of Listing on CSE SME

Eligible criteria of Small Capital Companies for Qualified Investor Offer (QIO):

The following eligible criteria shall be fulfilled by the Small Capital Companies before QIO –

- The company must be a public limited company by shares.

- The Paid-up capital shall stand from Tk. 50 (fifty) million to below Tk. 300 (three hundred) million, after raising capital through the QIO;

- Issue Manager shall in no way be connected with the issuer, nor does hold any of its securities;

- No material change including raising of capital after the date of Audited financial statements as included in the prospectus shall be made;

- Latest financial statements shall be audited by any firm of Chartered accountant which is in the panel of the Commission;

- The financial statements shall be prepared in accordance with the requirements of the provisions of IFRS or IAS (as applicable for small and medium sized entities) and audited the same as per International Standards on Auditing (ISA) as well as the Companies Act, 1994 and other applicable legal requirements;

- Cost audit by professional accountants as per the Companies Act, 1994, if applicable;

- It has complied with:

- all the requirements of the rules in preparing prospectus;

- provisions of guidelines regarding valuation of assets; if any, as published by the Commission

time to time;

- The issuer company or any of its directors shall not be a bank defaulter;

- Regular in holding Annual General Meeting (AGM);

- Positive net profit after tax at least for immediate preceding two financial years, if it offers its securities above the par value;

- At least 50% of the issue shall be underwritten on a firm commitment basis by the underwriter(s).

The following additional requirements are also applicable for application under book-building method:

- Before QIO, the issuer has minimum paid-up capital of Tk. 100 (one hundred) million;

- The issuer has been rated by a credit rating company registered with the Commission;

- At least 50% of the issue has been underwritten on a firm commitment basis by the underwriter(s).

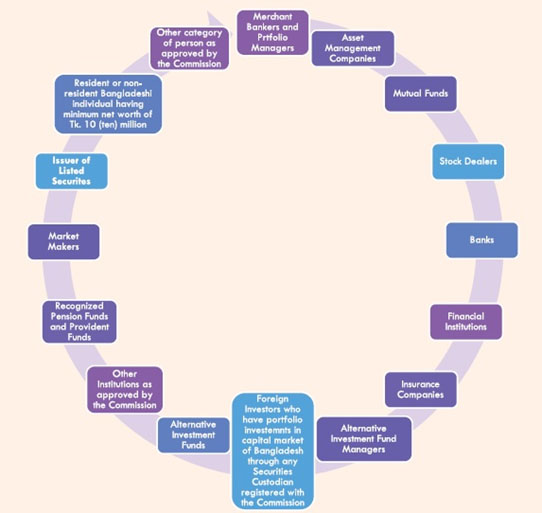

- Qualified Investors:

Qualified investor or “QI” means the “eligible investor or EI” as defined in rule 2(1)(e) of the Bangladesh Securities and Exchange Commission (Public Issue) Rules, 2015. The Small Capital companies shall make offer of securities to the Qualified Investors (QI) only.

- Who are the Qualified Investors:

-

Offering Method to QIO

Small Capital Companies can make Qualified Investor Offer in the following method:

- Fixed price method, when offered at par value; or

- Book-Building method, when offered above par value.

-

Issue Management

Issue managers play a very important role in the IPO process and also have in post listing phase. The issuer shall appoint one or more issue manager(s), registered with the Bangladesh Securities and Exchange Commission, for the purpose of making the qualified investor offer. The issue manager(s) shall be responsible for the issue including the preparation and disclosures made in the prospectus as well as the disclosures related to the use of the issue proceeds by the issuer. The maximum issue Management fee is Tk. 3,00,000.00 for fixed price method and Tk. 5,00,000.00 for Book building method.

-

Underwriting

The issuer desires qualified investor offer can appoint underwriter(s), registered with the Bangladesh Securities and Exchange Commission, on a firm commitment basis. The maximum underwritten fee is 0.25% of the amount underwritten in both the fixed and Book building method.

-

Steps for approval of Small Capital Companies to QIO

The following steps are required to follow by Small Capital Companies to get approval:

- Submission of application to BSEC for consent of issuance of securities and the exchange(s) for listing as per requirement of Rules and relevant listing regulations.

- Posting the draft prospectus/ red-herring prospectus/ information memorandum in the website of issuer, issue manager(s) and exchanges(s).

- Primary recommendation to the Commission by the exchange(s) along with the checklist within 20 days of receipt of the application after due examination of the same in line with the provision of the rules.

- Verifying the application, documents and primary recommendations of the exchange(s) by the Commission;

- The Commission or the exchange(s) may require the issuer or its directors, officers, issue manager(s), auditors and valuer(s) to submit additional disclosure, information, documents, certification and clarification, as the case may be, to produce or to disclose, in the draft prospectus or red-herring prospectus or information memorandum, within such time as may be stipulated;

- The issuer or its directors, officers, issue manager(s), auditors and valuer(s) shall fulfill such requirements within the stipulated time;

- Submission the final recommendation with declaration as prescribed in the listing regulations of small capital companies by the exchange(s) to the Commission within sixty days of receiving the application and all the communications to or from the exchange(s) shall be intimated to the Commission;

- If the Commission accords consents, the issuer or issue manager shall send invitation to the qualified investors along with the vetted prospectus, through e-mail and posting in the websites of the issuer, issue manager and the exchange(s), giving at least ten working days’ time, to submit application through electronic subscription system indicating the subscription period and other relevant information;

- Qualified investors shall apply for their intended subscription quantity and deposit full application amount in advance in the designated bank account maintained by the exchange receiving the subscription;

- Conducting subscription through an uniform and integrated automated system of the exchange(s);

- Qualified investors shall apply for their intended subscription quantity and deposit full application amount in advance in the designated bank account maintained by the exchange receiving the subscription.

- After closing of the subscription, qualified investors shall be allotted securities on pro rata basis as per their intended quantity, and the final allotment list shall be sent through e-mail to the allottees and disseminated through posting in the websites of the issuer, issue manager and the exchange(s).

- The issuer and the issue manager shall submit, with relevant documents, the status of subscription, list of qualified investors with number of securities subscribed and allotted, to the Commission and the exchange(s), within ten working days from the day of publication of the allotment list;

- The issue proceeds shall be transferred to the issuer’s bank account after listing of the securities with the exchange.

-

Self-test Readiness – before you start for a Listing

- Develop an understating of the capital markets and the various processes involved in raising fund through an QIO.

- Weigh the IPO option vis-a-viz other options of raising funds.

- Once you choose to opt the QIO route make a realistic assessment of your readiness for listing.

- Start upgrading and strengthening your internal process and systems to meet the requirement of public listed company.

- Crystalize your project and capital raising plans.

- Engage an Issue manager to assist you in the QIO process.

-

Fees of Small Capital companies for QIO and for its listing

|

Types of fees |

Fixed Price Method |

Book-building Method |

|---|---|---|

|

Issue management fee |

Maximum Tk. 3,00,000.00 |

Maximum Tk. 5,00,000.00 |

|

Underwriting fee |

Maximum 0.25% of the amount underwritten |

Maximum 0.259c of the amount underwritten |

|

Application fee for the Commission |

Tk. 5,000.00 (Non-refundable) |

Tk. 5,000.00 (Non-refundable) |

|

Consent fee for the Commission |

Tk. 10,000.00 |

Tk. 10,000.00 |

|

Listing fee for Exchange |

As per listing regulations for small capital companies |

As per listing regulations for small capital companies |

|

Other fees |

As per listing regulations for small capital companies |

As per listing regulations for small capital companies |

*Provided that, the Commission may, from time to time, revise the above-mentioned fees through

such orders, as may deem fit, by publication in the official gazette.

__________

Criteria for Migration to the Main Board

If the paid-up capital of a company becomes BDT. 300 million or more it shall compulsorily apply for listing with the main board of the Exchange(s) following due formalities within next two years of achieving the paid-up capital.

Compliances – Comparative Analysis CSE SME & CSE Main Board

|

Features |

Main Board |

CSE SME |

|

|

Pre-Listing requirement |

Paid up capital requirement |

The minimum existing paid up capital is BDT. 150 (one hundred and fifty) million. In addition, a issuer can offer an amount of at least equivalent to 10% of its paid-up capital (including intended offer) or Tk.150 million at par value, whichever is higher. |

After raising capital through the QIO, the paid-up capital shall stand at least Tk. 50 (fifty) million and below Tk. 300 (three hundred) million; |

|

Lock-in |

The lock-in for ordinary shares of sponsors shall be for 3 (three) years. |

The lock-in ordinary sponsors shall (one) year. for shares be I (one) year. |

|

|

IPO Underwriting |

The issue shall be at least 35% underwritten in both the fixed price and Book building method. |

The issue shall be at least 509c underwritten in both the fixed price and Book building method. |

|

|

IPO application amount |

Tk. 5,000.00, if offers at par value. |

Tk. 1,00,000.00, if offers at par value. |

|

|

Investors Nature |

Issuer makes offer of securities to the eligible investors, retail investor and others. |

Issuer makes offer of securities to only the Qualified Investors. |

|

|

Road/Web show |

Needs to conduct road show for Book Building method. |

Issuer and Issue manager will arrange web show to qualified investors (QI) about the issuance of securities disclosing all the features including facilities for online discussions, comments and questions by qualified investors. |

|

|

Issue Management Fee |

1% on the public offer amount or R. 3 million whichever is lower in fixed price method and 2% on the public offer amount (including premium) or Tk.5 million whichever is higher for Book building method. |

Maximum Tk.3 lac for fixed price method and Tk. 5 lac for book building method. |

|

|

Underwriting Fee |

Maximum 1% on 3$% of the public offer amount in fixed price method and maximum 1% on 35% of the public offer amount ( including premium) in Book building method. |

Maximum 0.23% of the amount underwritten in both fixed and book building method. |

|

|

Application fee for BSEC |

BDT.10,000/- |

BDT.1,000/-(non- refundable) in both fixed and book building method. |

|

|

Consent Fee |

0.40% on the public offer amount. |

BDT. 10,000/- in both fixed and book building method. |

|

|

Post-Listing requirements |

Migration opportunity |

Not applicable |

Migration front SCC Platform to main board. |

|

Financial Reporting |

1" Quarter, Half yearly, 3rd Quarter and Annually |

Annually only. |

|

|

Compliance requirements |

More |

Flexible |

|

|

Corporate Governance Guidelines |

Compulsory |

Not applicable |

|

©2024 Chittagong Stock Exchange PLC. All rights reserved.

20:43:57 (BST)

20:43:57 (BST)